At Rio Tinto's investor conference in Sydney earlier this month Sam Walsh, respected chief of iron ore at the world's number two producer of the commodity, showed two slides that neatly sum up supply and demand in the iron ore market.

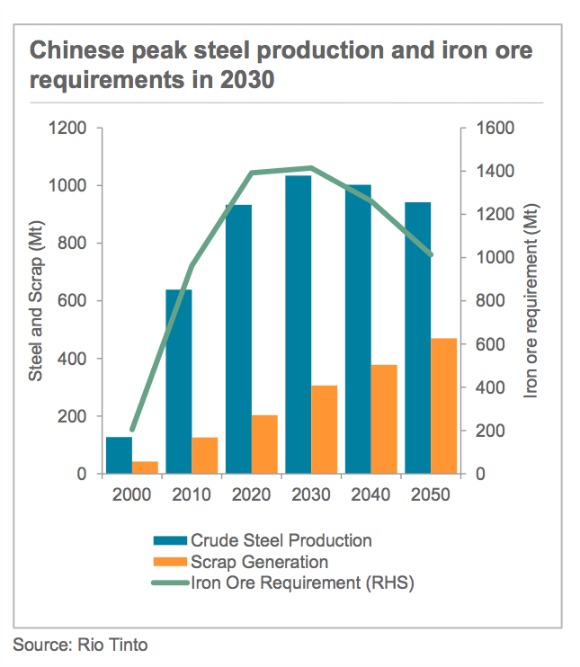

Demand from China – the principal driver of the market – will continue its steep climb for the rest of this decade and into the next before peaking around 2030:

While consumption will stay robust over the next several decades, supply continues to lag behind.

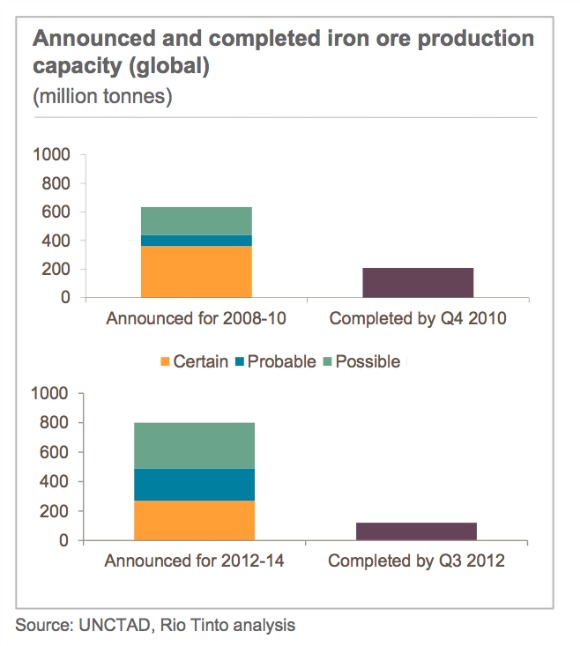

Competition for labor, energy and project financing is increasing, approval processes are being drawn out further and costs of building mines in remote areas continue to escalate.

The graph below shows just how wide the gulf is between miners' plans and execution:

Walsh says this shortfall will be made up by Chinese domestic supply in the short and medium term.

And mining iron in that part of the world certainly isn't without its challenges.

Please follow Money Game on Twitter and Facebook.