Social Security has been providing Americans with old age, disability, and widow and orphan insurance for as many as 77 years. But like so many of today's crucial financial topics, it's also shrouded in myth. Here are five big ones.

Myth No. 1: Social Security is going bankrupt

The biggest misunderstanding out there relates to Social Security's financial challenges. (A Google search for "Social Security bankruptcy" turned up 50 million hits.) But the fact is that Social Security isn't going bankrupt, nor is bankruptcy really possible as the system is currently set up.

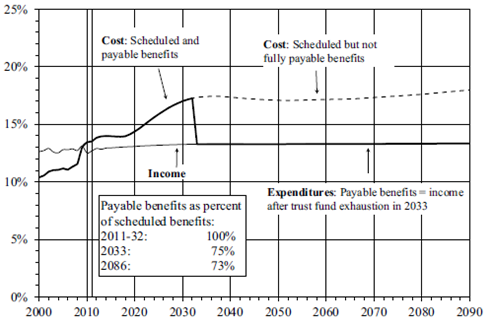

Here's the source of the confusion: Historically, Social Security has collected more than it paid out. The extra money built up in a trust fund that collects interest. But due to demographic and economic changes (more on that in a minute), it's expected that insurance payments will begin to exceed income in 2021. Around 2033, the fund will run out.

But even then, the revenue Social Security collects each year would still be enough to pay out about three-quarters of scheduled benefits as far as the eye can see.

Source: Social Security Administration.

In short, to say Social Security is going bankrupt, you have to ignore its revenues. But by such a weird standard -- ignoring revenues and seeing how long it would take expenses to drive tangible net assets to zero -- the average member of the Dow would go "bankrupt" in just under three months. (Fascinating bonus trivia: At nine months, Microsoft would survive the longest, while United Technologies wouldn't last two hours, and eight Dow blue chips –DuPont, Boeing, IBM, Pfizer, Hewlett-Packard, Procter & Gamble, AT&T, and Verizon -- would already be bankrupt. Again, that's because ignoring revenues doesn't make sense.)

Of course, doing nothing would mean that Social Security won't be able to meet its full obligations two decades from now. But it's not going bankrupt.

Myth No. 2: Meeting Social Security's future shortfall is really hard

We only need to come up with about 0.9% of GDP in order to make Social Security's revenues match up with its expenses for the next 75 years. To put that into perspective, 0.9% is close to the cost of unemployment insurance, the high-end Bush tax cuts, or one-fifth of the Defense budget. That's not insignificant, but it's hardly apocalyptic.

There are two basic ways to close that gap. We could increase payroll tax revenue by raising the cap (currently any personal income beyond $110,100 is exempt from Social Security payroll taxes) or raising the rate. Or we could cut benefits by lowering payments and/or raising the retirement age. Other strategies could include things like allowing more immigration to reinforce the population of working-age citizens or paying for it out of the general fund, but they aren't discussed as often.

Generally speaking, polls tend to show more support for revenue increases than benefit cuts, though there are plenty of different options. To get a sense of what they are, here are a bunch of different tweaks the Congressional Budget Office examined that could help us reach that 0.9% threshold:

Source: Congressional Budget Office.

Myth No. 3: Social Security's financial challenges are due to rising life expectancies

This one's only partially true. For the past few decades, there have been about three workers for every Social Security beneficiary. It's estimated that ratio will fall to around two by 2035. Since Social Security's revenue is generated by workers, a rising proportion of beneficiaries to workers puts a strain on the system. The idea that it makes sense to cut benefits by raising the retirement age naturally arises out of the fact that life expectancies are rising.

However, three things are important to keep in mind. First, a declining proportion of workers to beneficiaries doesn't automatically mean Social Security can't support its beneficiaries because workers become more productive over time. Since 1980, productivity per worker has increased by 78%.

Second, although it's true that life expectancies at birth have risen quite a bit over recent decades, the more important metric -- life expectancies for 65-year-olds – have only risen by about two years since 1980. What's more, the same seniors who don't have sources of income besides Social Security haven't seen the same gains in life expectancy and often work in physically demanding jobs that are harder to perform at 70.

Finally, there are other, perhaps more significant reasons for the projected shortfall, including declining birth rates and rising income inequality over the past several decades.

Myth No. 4: Social Security adds to the deficit

Social Security can't add to the deficit, because it has its own funding source (Social Security payroll taxes) and isn't allowed to spend any money it doesn't have. Much of the confusion comes from the fact that under federal accounting practices Social Security is represented in the consolidated federal budget, as well as from the fact that Social Security's trust fund, like many insurance funds, invests in Treasury bonds. (Bonds are debt investments.)

The exception has been the payroll tax holiday, which lowered payroll taxes starting in January 2011 in order to stimulate the economy. During that period, the federal government made up the lost revenue to Social Security that would have been collected. The holiday is expected to end next year.

Myth No. 5: Social Security only provides retirement benefits

Social Security isn't a retirement savings plan. It's actually a universal insurance program that helps protect workers, retirees, and their families from life's unknowns. Most Social Security benefits do support retirees via old-age insurance, but some also provide insurance in case people become disabled, widowed, or orphaned.

Source: Social Security Administration.

Keep in mind...

Social Security makes up the majority of income for two-thirds of all retirees. And it will continue to be around unless we decide to eliminate it.

At the same time, Social Security was never meant to cover our full income needs during retirement. The average retirement benefit last month was $1,235 -- an important chunk of income -- but probably not enough by itself to live off of comfortably. Retirement experts generally estimate that maintaining a preretirement lifestyle requires about 70% of preretirement income.

So, if you're still in your working years and have paid off any high-interest debt, make sure that you're setting aside and investing some money each month. When it comes time to retire, you'll thank yourself.

Don't Miss: 17 signs America's heading for a retirment crisis >

Please follow Your Money on Twitter and Facebook.