The final episodes of Arrested Development come out May 26, 2013.

Learn how to avoid the financial disaster plaguing the Bluths with our compilation of financial lessons learned from Arrested Development!

1. Keep an emergency fund

For the Bluths, there’s always money in the banana stand. Hopefully you can keep yours in a more secure location that offers a decent interest rate, such as a savings account at a bank or credit union. Check out NerdWallet’s advice on saving for a rainy day fund.

2. Make a budget and figure out how much you spend

Lucille Bluth had no idea how much bananas cost, and that family ended up in financial ruin. Be aware of your spending habits and budget accordingly, and use a cost of living calculator.

3. Don’t let anyone push you into making a decision you are not comfortable with

Even if you have a financial advisor, don’t take their recommendation without doing some of your own research. Buster didn’t have to be in the army just because his mom told him to, and you don’t have to sign up for a high-fee checking account just because a banker recommended it to you. NerdWallet’s Ask an Advisor platform is a great resource to find answers from financial advisors for your money questions.

4. Think outside of the box

Just like Ann and her mayonegg, there may be a financial decision that’s right for you, but you haven’t thought of it because it is outside of the norm. From debt consolidation to prepaid debit cards to leasing furniture rather than buying, make sure you think of all your options.

5. Don’t be a chicken and procrastinate

Everybody puts off the things they don’t want to do, but it pays off to get over your fears and avoidance and just do the things you are dreading, such as paying bills, switching to a cheaper checking account at a credit union or calling your health insurance to contest a claim.

6. Be aware of what shows up when people Google you

Just like George Michael’s Star Wars video, incriminating pictures or news can follow you throughout your professional career. You may decrease your earning potential by locking yourself out of some job opportunities. Before you drunkenly agree to an interview with the school paper during the homecoming game when you have letters written on your chest in body paint, think about how that interview might look to a potential employer a few years down the road when you’re looking for a job.

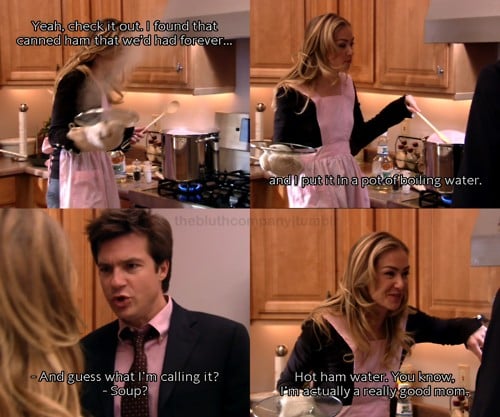

7. Reduce, reuse and recycle

While you don’t have to go as far as to make hot ham water, reducing your waste and clutter helps your wallet as well as the environment. Try to use all the groceries that you buy, and don’t make purchases unless you’re sure they won’t be left in a closet indefinitely.

8. Make a will and other financial plans in case of your death

Gob’s coffin has a trapdoor in the back, and you should have a plan to provide for your loved ones in case of a tragedy.

9. Know your priorities

Family and breakfast are top priorities for Michael and George Michael. Figure out yours and stick to them—if it means a lot to you to be at a friend’s wedding, splurge on a ticket. While budgeting and finances are important, your happiness is more important.

10. Don’t give up

Things may be hard, but don’t give up. It’s easy to become resigned to your credit card debt or high bills, but there are always steps you can take to improve your financial situation, whether that means moving to a cheaper apartment, negotiating for a raise or filing for bankruptcy.

And if all else fails, try the good old slow wink and marriage proposal. Good luck with your finances and enjoy the new episodes of Arrested Development!

Please follow Your Money on Twitter and Facebook.